01 May How Can Startups Survive in a Period of Stagnation and Global Uncertainty?

May 1, 2024

When markets are rising, the geopolitical situation is stable, and the value of money is low (indicated by the low-interest rates), pockets are wide open, and investors are much more inclined to invest in startups based solely on the team members and a well-written White Paper.

The Current Situation

However, the current situation is different. Interest rates are high. We have an unstable geopolitical situation. It is also a well-known fact that people are afraid of the ignition of a global conflict — nobody is certain anymore what person A will decide to do tomorrow. Additionally, it’s becoming clear to almost everyone that the world is undergoing tectonic shifts, transitioning from a unipolar to a multipolar one. According to some analysts, including Ray Dalio, this process will continue for about twenty to thirty years and most probably will end somewhere around 2050.

In essence, the prevailing mood is to invest money in low-risk assets. It is no coincidence that the price of gold has increased so much in the last year. For centuries, gold has been considered a safe-haven asset, and nowadays it reflects three things: fear, the inflation of fiat currencies, and the purchase of gold by China.

What Does This Mean for Startups?

In short, for startups, this means that if you want to attract investment, you are more likely to need to bootstrap your startup to the stage of having a customer base generating a relatively stable revenue stream, so that when you stand before an investor, you have something to show. This way, the investor can more adequately assess whether the risk is worth taking.

The times when your charisma played any role is over. Now what matters is real data and cash flow.

Which Startups Can Stand Out?

As for which startups would thrive in the current situation, that is a difficult question, as it directly depends on a future, which as we see is not very certain.

Still, if I have to give a direction, I think that several things will be important in the next few years.

Reducing Costs

Due to high inflation, the cost of producing and delivering goods has increased drastically in the last few years. Therefore, a startup that can offer reduced logistical expenses and facilitate customer access to goods would have great potential. As I am writing this, I can immediately name one startup that already does that — a startup company based in Bulgaria, EU founded by a friend of mine.

Energy

Another vital thing in the foreseeable future will be energy. There’s a lot of talk about Artificial Intelligence, but keep in mind that to power all these chips and machines, a tremendous amount of energy is required. Much more than what the standard electrical grid can provide. Therefore, to have an AI era, first, we need to build new energy capacities. This is a heavily regulated sector and, therefore, it will not happen overnight; it will take years. However, for startups, this means the following: Startups that are directed in one way or another towards the energy sector have a future.

Resources

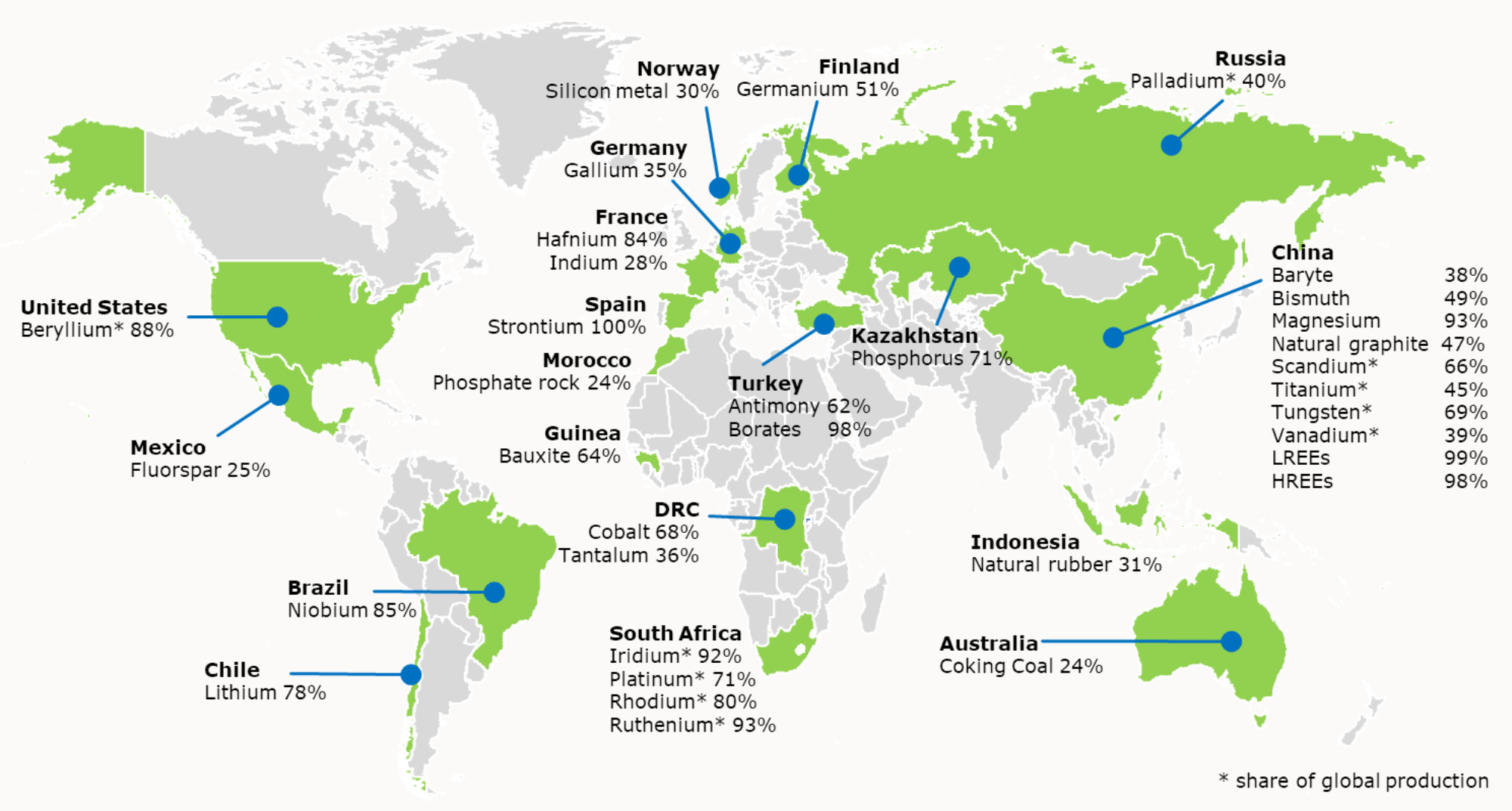

Another factor to consider is resources. Open a map of the world and see who controls the key mines globally. For example, you will find out that China has claimed a large number of mines in Africa. Additionally, some other key resources are located in Asia. Meanwhile, the development of new technologies — such as chips, solar panels, wind turbines, etc. — requires these resources. In my opinion, in the coming years and decades, resources will play a key role in the geopolitical situation.

If the TV news reports that a new conflict has erupted somewhere around the world, citing the beliefs of Dictator X and the unacceptable ideology of a group of fanatics Y, along with more purported facts like blah-blah-blah… remember the following:

Ideology is for fools and kids. The true motives are known to only a few – but they are most likely related to power, control of key routes, and resources.

Startups that develop technologies addressing the issues related to the lack of resources will, I believe, attract significant attention.

Financial Services

Imagine having little money in your pocket and savings in your bank account that you’re worried about due to high inflation. Now imagine someone comes to you and presents a solid investment plan in certain sectors with the ultimate goal of protecting your savings. Would you be open to listening to that person?

I bet the chances of you attending the presentation are much higher compared to if you weren’t concerned about your savings — the necessity creates demand.

Therefore, in a period of stagnation and uncertainty like the one we are anticipating, it is more likely that financial services or consultation businesses will emerge.

Let me ask you a question: Buying physical gold is a good way to hedge risk in your portfolio, but do you know exactly what type of physical gold to buy and why? If you don’t, that’s where startups that can advise you come in.

This example is not limited to gold alone. Any startup that solves financial issues in a period of stagnation may attract attention.

Water

Of all the water on Earth, more than 97% is saltwater found in oceans and seas, which is not suitable for drinking without desalination. Only about 2.5% of Earth’s water is freshwater, and the vast majority of it is trapped in glaciers, ice caps, and beneath the surface in aquifers. Only a tiny fraction of the Earth’s freshwater, roughly 1.2% of the total water on the planet, is accessible in rivers, lakes, and in the atmosphere, and even this water requires treatment to become safe for human consumption.

Years ago, I was invited as a speaker for the GoViral event in Almaty, Kazakhstan, where I met an American investor who lived in Nigeria because he was actively working on systems for water collection and filtration. He was an investor in these systems and he wanted to keep a close eye on the whole process.

He told me one thing: In the future, water will become very valuable, and companies working on producing freshwater will make really good money.

AI Integration Engineering

Imagine living during the latter part of the 19th century or the early 20th century. You own a tailoring business with 50 workers who use mechanical machines powered by their own foot movement on a treadle plate. The treadle moves a drive belt that powers the sewing machine’s needle and bobbin.

The issue here is that you already know about competitors who implemented electrical machines in their factories and their productivity increased multiple times.

You’d like to do the same by replacing the old machines with electrical ones. To achieve this, you hire a consultant who advises you on what type of machines to buy, and you also engage a company to connect you to the electrical network.

Your next move is to follow the expert advice. You purchase the machines and hire the company. Not only that, but you also sign a contract with the electrical company for emergency visits — essentially to maintain your infrastructure.

Now, imagine the same situation nowadays. You own a business and you’d like to stay competitive by adopting various AI tools. Your next step is to pick up the phone and call Company X, offering extensive services in AI area. A consultant is scheduled to visit your office to discuss your business, all of its components, and how to integrate AI to drastically increase productivity in your company.

Startups focused on providing AI services to other businesses, I believe, are going to be an emerging profession similar to electricians during the latter part of the industrial revolution.

In Summary

The future, as uncertain as it may seem now, has many problems to be solved.

If there are problems, there is room for business.

However, since that same future is combined with uncertainty, it means that money will be very cautious, which for startups means that they will need to exert much more effort and spend more of their own funds before attracting the attention of the investors.

Also, we should no longer fool ourselves by working on projects and businesses that only spend money and bring nothing real to society. A period like this requires us to spend money wisely on businesses that focus on essentials and actually bring value.

Therefore, the situation looks difficult, but in fact, if you are smart, know the right people, take the right actions, and you are lucky, you may benefit from it.

Above, I outlined six areas where new startups may flourish in the near and distant future, but don’t limit yourself to just these. Read books, watch geopolitical analyses, start investing with a long-term goal in mind — in short, try to discern the trends of the near future. Based on that, you may discover new ideas for a startup business with great potential.

Key Takeaways

- Interest rates are high. We have an unstable geopolitical situation. People are afraid of the ignition of a global conflict. The world is undergoing tectonic shifts, transitioning from a unipolar to a multipolar state.

- Due to global uncertainty, money will be cautious, which means startups will need to exert much more effort and spend more of their own funds before attracting the attention of investors.

- If there are problems, there is room for business. Therefore, smart startups will always find opportunities.

- Example sectors – reducing delivery costs; energy sources; resources; financial services; water supply; AI integration engineering.

References

Price of gold – TradingView.com

“The Changing World Order” by Ray Dalio

“Where is Earth’s Water?” by Water Science School

“Study on the EU’s list of Critical Raw Materials (2020) Final Report”